Tax Changes - 31 July 2024

Simplified Explanation of Upcoming Income Tax Threshold Changes

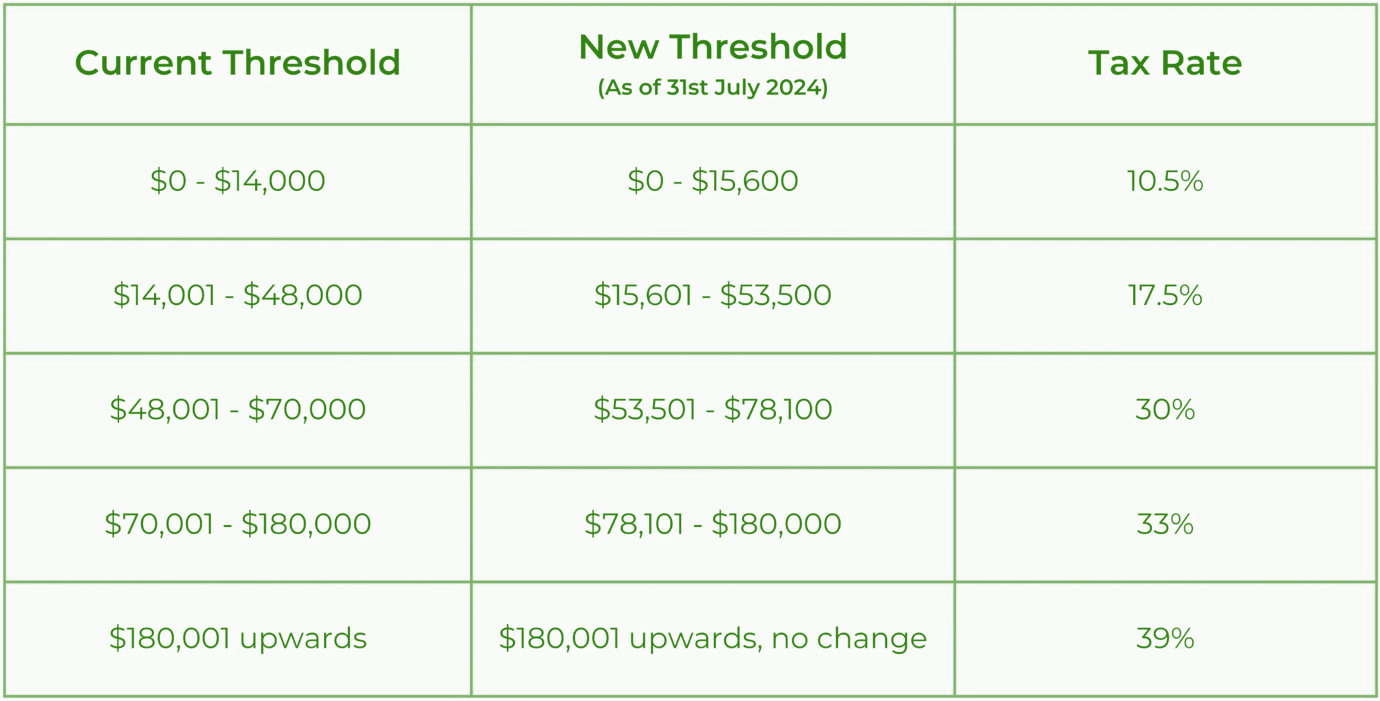

From 31 July 2024, there will be changes in the income tax thresholds. It’s important to check with your payroll provider to ensure these updates are

reflected in your payroll system.

Why this is Important:

New Zealand uses a progressive tax system, which means the more you earn, the higher your tax rate. These tax rates are split into different income

ranges called tax bands. The government has decided to adjust the thresholds for these bands. As a result, you'll pay less tax since more of your income

will fall into the lower tax rates.

What's Changing?

Although the tax rates themselves aren’t changing, the income ranges (thresholds) for each rate are. Here’s a comparison between the current and

new thresholds. Make sure these changes are noted and applied to avoid any payroll issues.

What you'll see when processing payroll:

Net Amount Changes:

As you process payroll, you'll likely notice that your employees net pay amounts (the amount they take home) have changed. This shift is due to the

new tax rules, which mean different amounts of tax are being deducted.

Independent Earner Tax Credit (IETC):

If any of your employees are on ME or ME SL tax codes, you'll also see changes in the thresholds for the Independent Earner Tax Credit (IETC).

How to Ensure Accuracy:

The IRD website (Inland Revenue Department) has lots of useful information to help you. You can verify your payroll calculations there. If you're

curious or want to double-check the details, the IRD Employers Guide provides all the calculation rules.

For more detailed information, you can also check out the page on Personal Income Tax Thresholds here.